Discover true per product profitability

Augment your reporting

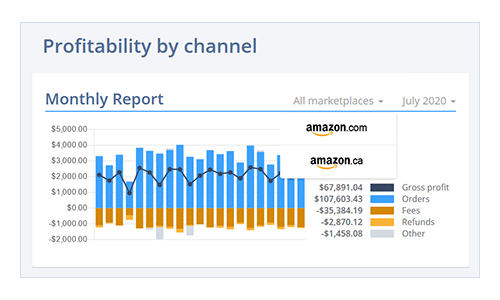

Analyze product profitability beyond limitations of NetSuite and QuickBooks

Drill down into fees

See actual COGS, Amazon commission, FBA fees, and advertising expenses

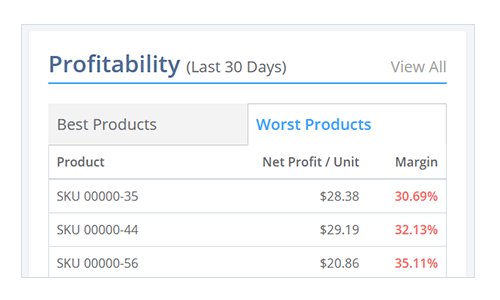

Optimize your product catalog

Use actual product profitability to make informed decisions to boost your profits

Step inside and see how it works

Entriwise is quick to sign up for, easy to use, yet advanced enough to support all your business needs

Cost of goods sold Actual COGS to calculate your product profitability

To track your product profitability, start with cost of good sold (COGS) defined in one of the two ways

- ✔ use actual COGS as reported by NetSuite or QuickBooks

- ✔ define COGS manually for each product

Available in plans:

Professional , Enterprise

Additional costs Extra-COGS to record additional expenses

Define non sales related expenses as extra-COGS to account for various fees like storage, FBA inbound, etc

- ✔ fixed extra COGS in your marketplace currency

- ✔ extra COGS as percentage of actual COGS, fees or total sales

Available in plans:

Professional , Enterprise

Sales fees Marketplace and processing fees as final cost component

NetSuite and QuickBooks cannot allocate your expenses to products sold. With Entriwise you will see your actual Amazon fees as costs, resulting in correct product profit and margin analytics.

- ✔ Amazon commissions

- ✔ Amazon FBA fees

- ✔ Amazon per SKU ad spend

Available in plans:

Professional , Enterprise

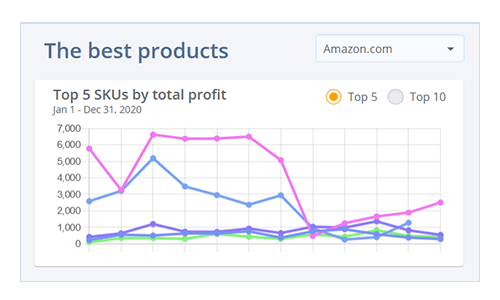

80/20 analysis to find your best 20% of products

To show your best products we're using the cost–volume–profit analysis by every Amazon SKU sold and applying 80/20 rule to each Amazon marketplace.

Trusted by merchants in various retail industries