Amazon QuickBooks Desktop Integration

Amazon Seller Central to QuickBooks Desktop integration: automated accrual accounting, advanced inventory sites, assemblies and group items, detailed fee mapping, and per-SKU COGS for Amazon sellers using QuickBooks Desktop Enterprise.

Using QuickBooks Desktop? See Amazon → QuickBooks Online.

Back to: all integrations | Amazon integrations | QuickBooks Desktop integrations

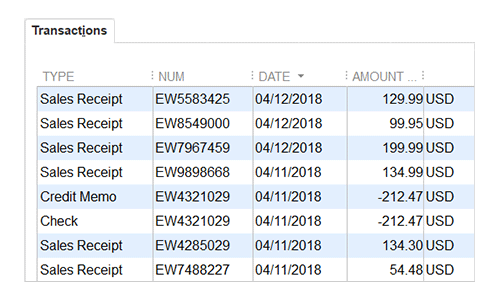

Import details Proper accounting without journal entries

- ✔ Sales receipts and invoices with line items

- ✔ Single transaction or daily batch import

- ✔ Daily summaries with daily imports

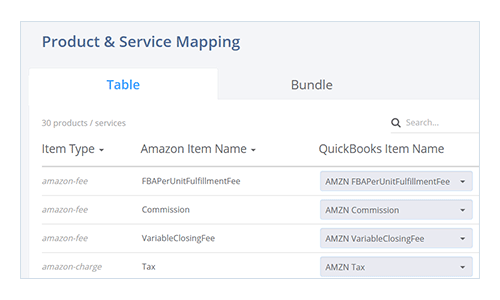

Item mapping Itemized mapping to record all income and expenses

- ✔ Fee mapping to QuickBooks items

- ✔ Flexible import timing and grouping options

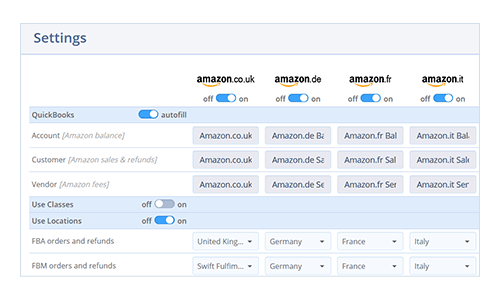

Advanced tracking Class-based reporting for Amazon channel analytics

- ✔ Class tracking for FBA and merchant-fulfilled

- ✔ Separate classes per Amazon marketplace

- ✔ Customer:Job tracking for multi-brand sellers

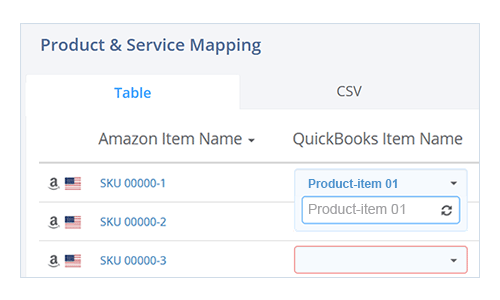

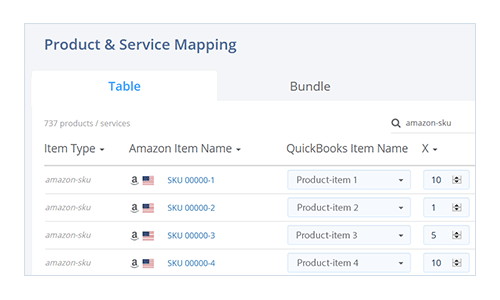

Inventory mapping Link Amazon SKUs to QuickBooks Desktop inventory items

- ✔ Match by SKU to QuickBooks item list

- ✔ CSV upload for bulk inventory mapping

- ✔ Interactive mapping interface with item lookup

Advanced inventory Assemblies, bundles, many-to-1 mapping for advanced inventory integration

- ✔ Group items and assemblies for multipacks

- ✔ Map bundle SKUs to assembly components

- ✔ Flexible pricing distribution across bundle items

Inventory sites Inventory sites for precise inventory tracking

- ✔ Sites for FBA, inbound, removal, and merchant-fulfilled

- ✔ Marketplace-specific site segmentation

- ✔ Real-time quantity on hand per site

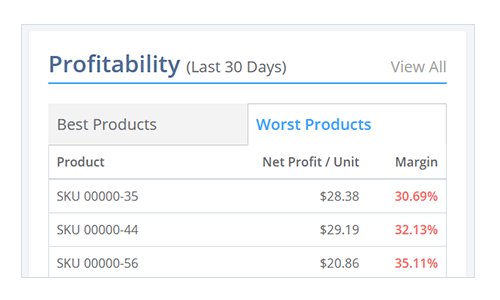

Cost of goods sold Actual COGS to calculate your product profitability

- ✔ Import item costs from QuickBooks inventory

- ✔ Set custom COGS per SKU for what-if analysis

ADDITIONAL COSTS Extra-COGS to record additional expenses

- ✔ Add flat fees per unit sold

- ✔ Apply percentage of item cost, sales, or Amazon fees

SALES FEES Marketplace and processing fees as final cost component

- ✔ Per-item Amazon commission tracking

- ✔ FBA pick, pack, and storage fee attribution

- ✔ Ad spend mapped to advertised products

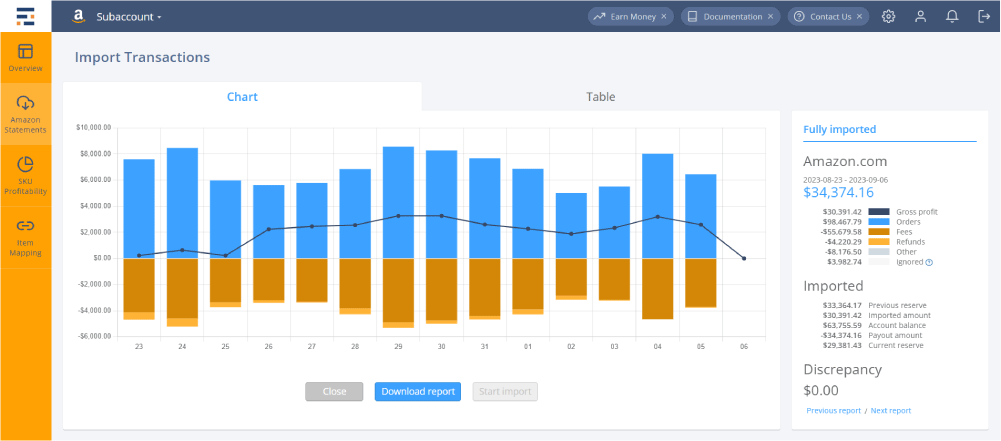

Your numbers will be reconciled to the penny!

Our unique automatic reconciliation algorithm guarantees 100% correct imports. Whether you process 1,000 or 1,000,000 orders per month, Entriwise imports will reconcile to the penny.

Looking for something else? Talk to our in-house CPA and advisors

professionals who understand e-commerce needs.

Together we will find a solution that works exactly for your company, allows up and running quickly, with less disruption to your business.