Amazon Seller Central QuickBooks Online Integration

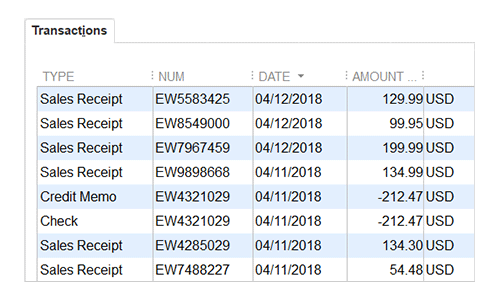

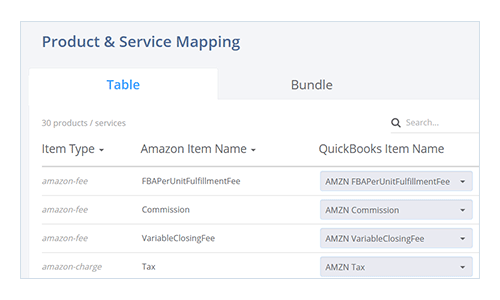

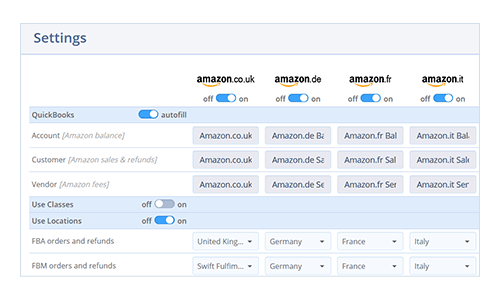

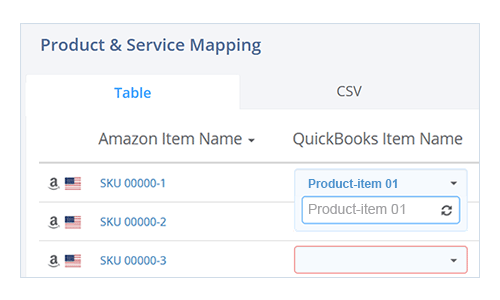

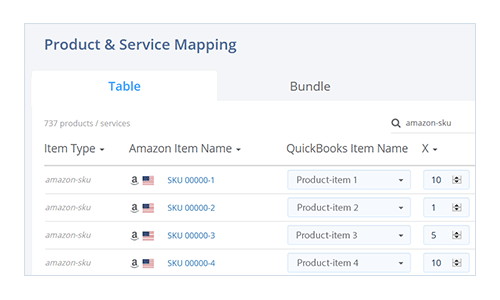

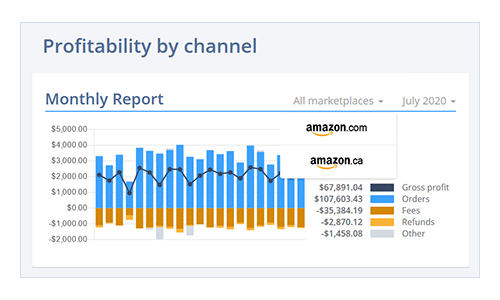

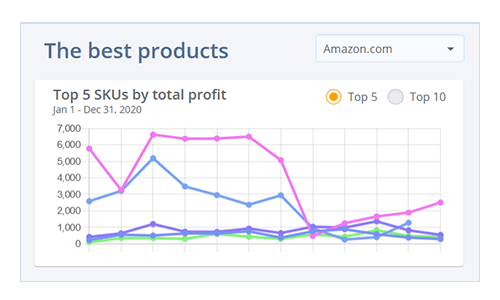

An Amazon QuickBooks Online connector that automatically syncs settlements, fees, inventory, and SKU-level COGS using accrual-based accounting.

Designed for growing Amazon sellers who need accurate settlement reconciliation, inventory tracking, and profitability reporting directly inside QuickBooks Online.

Learn best practices in our Amazon to QuickBooks Online integration guide.

Using QuickBooks Desktop? See Amazon → QuickBooks Desktop.

Back to: all integrations | Amazon integrations | QuickBooks Online integrations